Contents

A handle forms, which should be less than a third the size of the cup. A cup and handle pattern is formed when there is a price rise followed by a fall. The price rallies back to the point where the fall started, which creates a “U” or cup shape. The price then forms the handle, which is a small trading range that should be less than one third of the size of the cup.

Just short of the old highs at top#1 aggressive selling begins on no specific news but in reality some investors that bought near top#1 have already begun to sell. The stock begins to work significantly lower on increased volume creating a second, well defined top (top#2). Above is an example of two cup and handles that formed in the Big Tech share basket on our Next Generation trading platform.

It creates a U-https://en.forexbrokerslist.site/ or the „cup” in the „cup and handle.” The price then moves sideways or drifts downward within a small price range, forming the handle. As with most chart patterns, it is more important to capture the essence of the pattern than the particulars. The cup is a bowl-shaped consolidation and the handle is a short pullback followed by a breakout with expanding volume. A cup retracement of 62% may not fit the pattern requirements, but a particular stock’s pattern may still capture the essence of the Cup with Handle.

Here, you should wait for the price to retest the now-support level and place a bullish trade. An inverse cup and handle pattern is the exact opposite of what we have talked about. The pattern happens when the price of an asset is declining. Further, the pattern tells you not to worry when the price reaches at the resistance and either consolidates or starts retreating. Looking to see this one play out over a 7 day time frame.

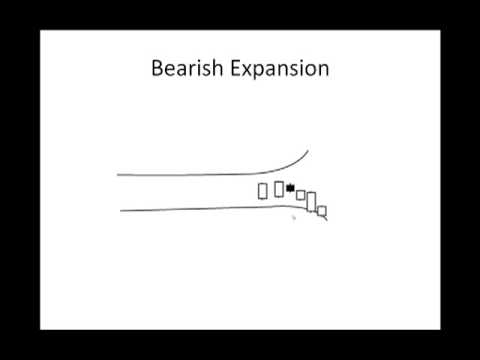

The handle forms as a subsequent, smaller upward movement at the top of the cup . A stop-loss controls the trade risk by establishing a level at which the trader should exit the trade . In the cup and handle chart pattern, a stop-loss is placed at the lowest point of the handle or the lowest point of the most recent swing. The stop-loss is usually located in the upper third part of the cup, corresponding to the position of the handle. An ‘inverted cup and handle’ is a chart pattern that indicates bearish continuation, triggering a sell signal. Cup and handle patterns typically are seen to occur on a daily chart after a strong trend has progressed for one or more months.

An inverted “cup and handle” is used to identify selling opportunities, which is a sign of an upcoming bearish movement. This pattern moves in the opposite direction to the cup and handle, forming an „n” shape and an upward handle. A cup and handle is considered a bullish continuation pattern and is used to identify buying opportunities. When the pattern is complete, a long trade could be taken when the price breaks above the handle. However, some traders make the mistake of assuming that once a U-shape forms, the price will drop to form a handle. It may not, so you should ideally avoid trading the pattern until it has fully formed, in order to confirm the trend.

What is a cup with handle pattern?

In any case, the handle should retrace less than 1/3 to 1/2 the depth of the cup – the shallower the retracement, the more bullish the movement following a breakout should be. The handle can develop over one week to several months on a daily chart, although ideally completes in less than one month. The target of the Cup and Handle pattern is the height of the cup added to the breakout of the resistance trend line connecting the two highs of the cup. Consider a scenario where a price has recently reached a high after significant momentum but has since corrected.

At this moment, the pattern is complete, with an expectation that the price will rise. The volume of trade should move along with the price of the stock. As the base of the cup forms, the volume should remain lower than the average. As the price rises, the volume of trade should also increase. Below is an example of an inverted cup and handle on the FTSE 100 weekly chart. Although the pattern formed and the price did decline, ultimately, the price did not follow through to the downside.

We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey. Handles are relevant to all financial markets, but mean different things depending on the asset. When it comes to trading, the term “handle” has two meanings, depending on which market you are… The Keltner Channel or KC is a technical indicator that consists of volatility-based bands set above and below a moving average. If the Cup and Handle pattern completes successfully, the price should break above the trend established by the “handle” and go on to reach new highs.

What happens after a Cup and Handle pattern forms?

Once you are done with all the checks, go to the preferred trading platform, and start trading. I accept FBS Agreement conditions and Privacy policy and accept all risks inherent with trading operations on the world financial markets. If a Cup and Handle forms and is confirmed, the price should increase sharply in short- or medium-term. A loose, choppy base shows the stock needs to go far for price discovery. If institutions are holding on to the stock, it won’t fall too far. The cup should form smoothly, without major price declines on the left side.

No one can explain how to trade cup and handle pattern better that way you have explained in this short article. The good thing with a buy stop order is your entry will just be above the highs of the “handle”, and if the breakout is real, that’s one of the best prices to get in. The objective of the cup with handle pattern is calculated by plotting the height of the cup on the handle’s breaking point. However, it is more advisable to only plot half the cup’s height according to T. The inverted cup and handle pattern is in direct contrast to the cup and handle pattern.

For traders, chart patterns are critical technical indicators that can help them predict price movements. The cup and handle pattern is one of the most popular forms of technical analysis that signifies a bullish trend. The pattern comprises the cup and the handle and resembles them in appearance. The cup and handle breakout point is when the pattern is complete, and traders can expect a continuation of the price uptrend. For the novice and the experienced trader, this chart pattern can help determine points of entry and exit in a trade.

It’s best to have a fixed set of rules to https://topforexnews.org/ breakout and then just trade it when it happens. For trend reversal, the duration of the cup would be longer. Its concept can be applied across markets which are liquid and across timeframes when the market is liquid as well. Also, give your stop loss some buffer below the swing low as you don’t want the price to breach the lows, and only to reverse higher.

Cup and handle patterns in stocks

If a cup and handle forms and it is confirmed, the price should see a sharp increase in the short- to medium-term. If the pattern fails, this bull run would not be observed. There is a risk of missing the trade if the price continues to advance and does not pull back. Completion of the cup and handle pattern occurs after the price breaks out above the high of the handle and zooms higher. In my opinion, the cup and handle pattern can be both a continuation pattern and a reversal pattern. If you trade chart patterns, you want to exit your trade when the pattern is completed.

The first example shows a shallow https://forex-trend.net/ and handle pattern developing over the course of approximately two to three months. The cup features a gentle pullback after a strong bullish movement and the right side of the cup reaches the same price level as the left side of the cup. The false breakout in the handle on August 13 occurs on low trading volume, demonstrating the importance of using trading volume as a method of confirming the breakout.

- 78% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

- Noting key resistance at top#1 and top#2, speculators begin to initiate short positions.

- After a cup and handle pattern forms, the price should see a sharp increase in the short- to medium-term.

- Finally, when the price breaks out of Resistance, the cup and handle pattern is “confirmed”, and the market could move higher.

The forming of this pattern allows the stock to base or take a “breather” before its next move up and is seen as healthy action. Cup and handle patterns seen in bear markets are generally not as reliable. Cup and handle patterns form as the result of consolidation after an uptrending stock tests its previous highs. At that level, traders who bought the stock near the previous highs are likely to sell, causing a gentle pullback. This pullback is then met with bullish activity, which causes the rounded bottom and rise of the right side of the cup. The pattern forms during as a result of consolidation a bullish movement and indicates a continuation of that bullish trend after its completion.

There is also an upside-down cup and handle pattern, called the inverted or reverse cup and handle. This is a bearish pattern and it looks different to the traditional cup and handle. This information has been prepared by IG, a trading name of IG Markets Limited. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk.

How Does Cup and Handle Pattern Work?

The cup and handle pattern is a bullish continuation pattern triggered by consolidation after a strong upward trend. The pattern takes some time to develop, but is relatively straightforward to recognize and trade on once it forms. As with all chart patterns, trading volume and additional indicators should be used to confirm a breakout and continuation of the original bullish price movement.

We’ll connect you with a designer who can make updates and send you the artwork in a format of your choice. 10 Best Demat Accounts in India for Beginners in Demat account was created to eliminate the time-consuming and inconvenient procedure of purchasing … Top 10 Chit Fund Schemes in India in Chit funds are one of the most popular return-generating saving schemes in India. Contract note is a legal document containing the details of every stockbroker’s trade on a stock ex… This article has been prepared on the basis of internal data, publicly available information and other sources believed to be reliable.

A profit target is determined by measuring the distance between the bottom of the cup and the pattern’s breakout level and extending that distance upward from the breakout. For example, if the distance between the bottom of the cup and handle breakout level is 20 points, a profit target is placed 20 points above the pattern’s handle. Stop-loss orders may be placed either below the handle or below the cup depending on the trader’s risk tolerance and market volatility. There are several ways to approach trading the cup and handle, but the most basic is to look for entering a long position.

As a general rule, cup and handle patterns are bullish price formations. The founder of the term, William O’Neil, identified four primary stages of this technical trading pattern. First, approximately one to three months before the “cup” pattern begins, a security will reach a new high in an uptrend.

The cup with handle is to serious investors in growth stocks what the single is to a baseball fan. It’s the starting point for scoring runs and winning the investing game. Investors who see a similar pattern where the handle goes deeper might want to make efforts to avoid it.